Average Daily Rate(ADR) vs. REVPAL: Which Is More Important in Dynamic Pricing?

Many people who are new to the short-term rental business or looking to grow their operations often first encounter the concept of ADR (Average Daily Rate) and view this metric as an indicator of success. However, it’s important to remember that ADR on its own can be misleading. A high ADR does not always equate to high revenue. What truly matters is the total income your property generates—and that’s where REVPAL (Revenue Per Available Listing) comes into play.

In this article, we’ll break down the ADR vs REVPAL debate, explain when each metric is more useful, and how you can develop smarter pricing strategies.

What Is ADR and Why Isn’t It Enough?

ADR, or Average Daily Rate, is a calculation of the total revenue earned over a given period by the number of days the property was actually rented. Here’s a simple example:

- Let’s say your annual total revenue is €6,000.

- If you earned this revenue over just 30 booked days throughout the year:

- ADR = €6,000 ÷ 30 = €200

At first glance, this figure might seem impressive. However, because ADR considers booked days the property was booked, it doesn’t provide insight into your occupancy rate or your property’s overall annual performance. If your property was available for rent all 365 days but only rented out 10% of the time, it means you haven’t truly maximized its potential.

To better understand where ADR falls short, consider the constantly shifting supply and demand in the short-term rental market. You might charge high prices and achieve “prime” revenue on some days, but if your overall occupancy is low, this strategy can end up hurting your total earnings.

What Is REVPAL and Why Is It a More Accurate Metric?

You calculate REVPAL by dividing your total revenue by the total number of days your property was available for rent. This metric takes into account both your pricing strategy and your occupancy rate. For example:

- Let’s say your annual total revenue is €20,000.

- Your property was available for rent all year (365 days).

- REVPAL = €20,000 ÷ 365 = €54.79

This metric measures your property’s full potential and helps you understand how unbooked days impact your overall performance. In the ADR vs REVPAL discussion, REVPAL focuses not just on your occupancy rate, but also on how effective your pricing strategy is in generating consistent income.

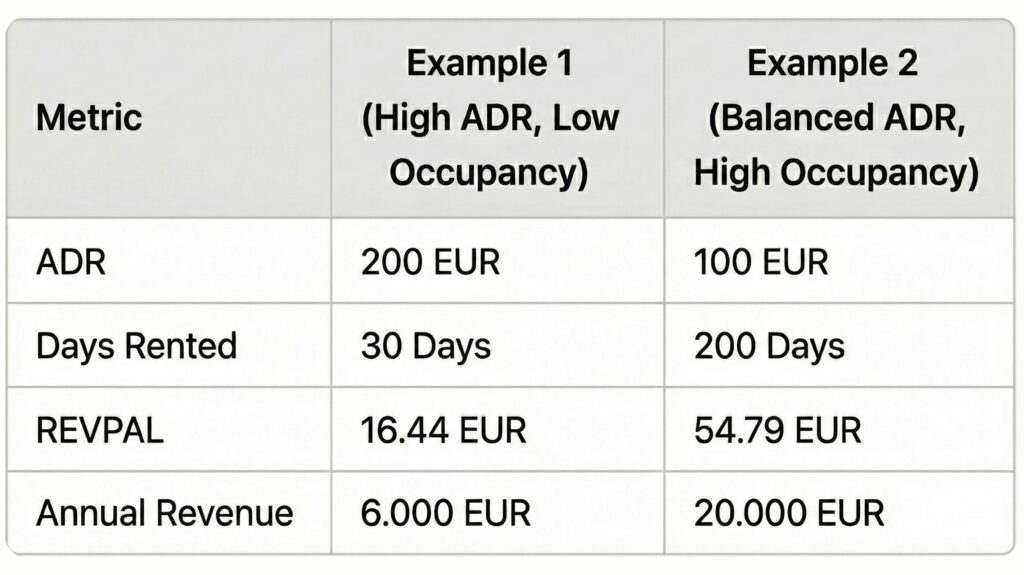

An Example Comparing ADR and REVPAL:

The following example clearly illustrates how ADR can be misleading and why REVPAL serves as a more accurate measure of performance:

In the first example, although the ADR is high, a low occupancy rate limits your annual revenue potential. In the second example, however, a higher occupancy is achieved with a lower ADR, and the total revenue increases significantly. This demonstrates why RevPAR is a better metric for understanding your property’s true performance.

A Professional Approach to Pricing

Dynamic pricing strategies are crucial for maximizing revenue. In the short-term rental business, your primary goal should be to sell every available day at the optimal price. Vacant days can be seen as unsold inventory, which leads to potential revenue loss.

At this point, by considering both ADR and RevPAR together, you can develop a more balanced strategy:

On Low-Demand Days: You can increase occupancy by offering lower prices. Every additional booking helps boost your RevPAR.

On High-Demand Days: You can raise your prices to capture premium revenue.

If your goal is to maximize income, remember that data, not emotional preferences, should drive your pricing decisions

Romantic Approaches and Realities

A common situation among individual property owners is their reluctance to rent out their properties below a certain price. This usually stems from an emotional attachment to their property. For example, they might think, “This house shouldn’t be rented for less than this amount.” However, from an economic standpoint, this is not a sound strategy.

Low prices do not always mean you are making a loss. On the contrary, such pricing can increase occupancy rates, helping you cover fixed expenses (such as electricity, gas bills, and furniture depreciation) and boost your overall income. It’s especially important for professional operators to understand that every additional booked day makes a positive contribution to RevPAR and increases total earnings.

Conclusion: Smart Strategy, Higher Income

If you want to maximize your earning potential in the short-term rental business, you should base your pricing strategy on data. Your goal should be to set the optimal price for each day and make every day profitable.

Dynamic pricing solutions are the most effective way to achieve these objectives. With the right strategy, both individual property owners and large businesses can unlock their property’s full potential.

About Homesberg

Boost your pricing strategy. With predefined Homesberg pricing models and the Base Price Helper, you can make smarter choices and get the most out of your listing.

Homesberg is an all-in-one vacation rental management platform built around the must-have features hosts truly need: self-reliant market data collection, an Airbnb ranking tracker, a robust dynamic pricing engine, and seamless integrations with all major channels. No more juggling multiple tools or paying for underutilized features.