Airbnb Commission Raise 2025: What Hosts Need to Know About the 15.5% Fee and Beyond

2025 has arguably been the year that shocked hosts the most, with update after update including Airbnb’s new commission is set to raise from 15% to 15.5% for most hosts, while also eliminating the split-fee structure where guests were charged instead of hosts.

In this article, while focusing primarily on the commission increase, we’ll look at the roots of this strategic move from Airbnb. We’ll discuss and share opinions on:

- Airbnb’s 2025 Commission Raise and removal of the split payout method

- Total price display standardized globally

- Airbnb’s 2025 summer release algorithm overhaul

- Airbnb’s revenue increase strategies including potential pay-for-visibility monetization

Airbnb Commission Raised to 15.5%

After the new Airbnb Commission raise, commission is set to be raised from 15% to 15.5% worldwide starting December 1, 2025.

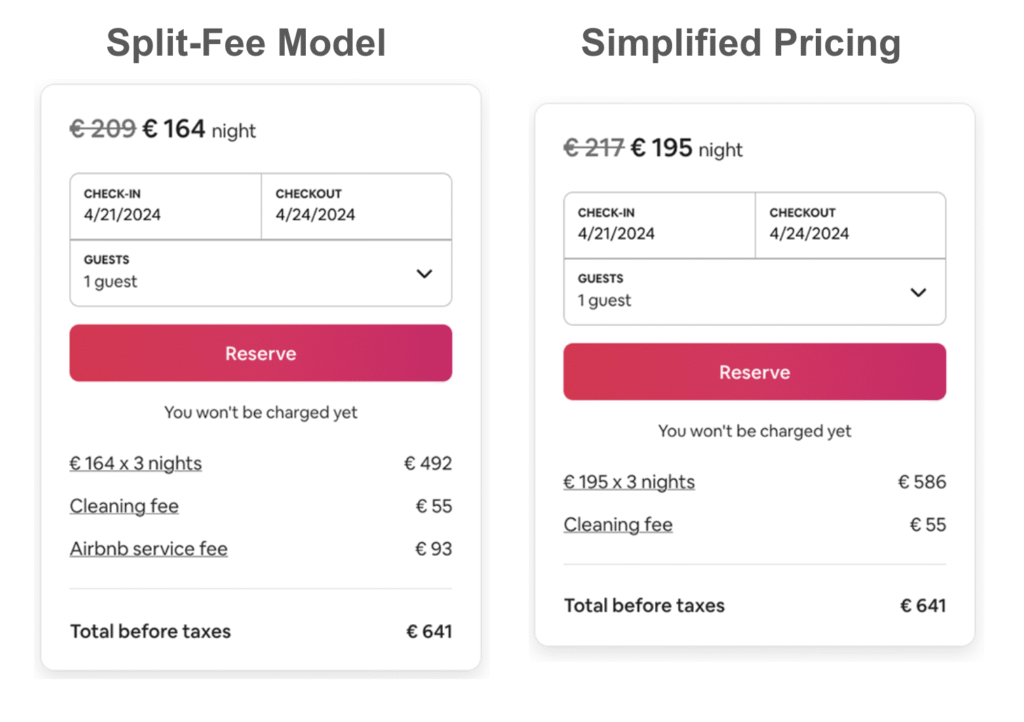

Some of you might think it’s increasing from 3% to 15% but that’s because you may still be on the legacy split pricing model. To better understand, let’s first review the difference between split-fee structure and simplified pricing.

Airbnb Split-Fee Model (Traditional)

- Hosts paid around 3% of the reservation subtotal.

- Guests paid a separate service fee around 12%.

- This structure remains optional (for now) for hosts not using PMS integrations.

Airbnb Single-Fee Model (Host-Only / Simplified Pricing)

- Guests no longer see a separate service fee. It’s fully embedded in the nightly rate.

- Fees typically fall between 14% and 16%.

- Many hosts will now transition to a flat 15.5% host-only fee.

Which Airbnb Hosts Are Affected and When?

Now → October 27, 2025

- Hosts using PMS must adopt the single-fee structure immediately.

- The split-fee option is no longer available to them.

- Most PMS-connected hosts will automatically move to the 15.5% host-only rate.

December 1, 2025

- Most non-PMS hosts will also transition to the 15.5% host-only model.

- From this date onwards, split-fee will be removed for good.

What This Means for Hosts

- Pricing Transparency – Guests won’t see service fees itemized; everything is baked into the price.

- Software Integration Matters – PMS users are already required to switch.

- Timing for Non-PMS Hosts – You have until December 1 before it’s automatic.

- Brazil Exception – Still at 16% under the host-only model.

Simplified Pricing: Airbnb’s First Move Against Direct Bookings

Simplified pricing was first introduced in mid-2020 as optional. A few months later it became mandatory for API-connected hosts, with the exception of the United States, Canada, Mexico, Uruguay, The Bahamas, Argentina, and Taiwan.

Airbnb argued that simplified pricing provided transparency and reduced booking friction. According to an internal Airbnb study, hosts experienced a 17% increase in bookings. Sounds great, doesn’t it?

At Homesberg, we believe this was Airbnb’s first front against operators managing multiple listings, who are always looking to increase direct bookings and eliminate channel fees. These operators rely heavily on PMSs and this mandatory change was clearly targeting them. The front expanded further with Airbnb’s 2025 summer release, but more on that in a bit.

Naturally, the move sparked backlash. Back then, Airbnb’s search algorithm used nightly rates to rank listings by price. Additional fees, including Airbnb’s commission, were only added on the final reservation page which hurt rankings for professional hosts. Although guests had the option to filter by “total price,” it took Airbnb nearly four years to make that the standard.

Airbnb Now Displays Total Prices on the Search Screen

After years of debate among hosts over whether split-fee or simplified pricing was better, Airbnb took one more step toward eliminating split-fee entirely. In April 2025, Airbnb announced that guests will now see total prices directly in search results.

This benefits guests, who now see the real cost upfront instead of being surprised with add-ons at checkout. But there was a catch.

Previously, guests saw Airbnb fees itemized on the listing page often prompting them to look for alternative ways to reach hosts (via company name searches, or even messages despite Airbnb’s strict terms). Now, with total price display, those fees only appear at the very last step of booking.

Think about it: for a company processing tens of thousands of reservations daily, which approach reduces guests’ questioning and attempts to bypass the platform? Showing the fee upfront, or at the very last step when the guest is already committed?

Airbnb 2025 Summer Release: A Declaration of War on Direct Bookings

Bad reviews or negative sentiments in high pointreviews lowers your ranking now!

In Airbnb’s 2025 summer release, the company tightened its off-platform policy with penalties ranging from temporary suspensions to full account closures. Imagine losing an account with hundreds, if not thousands, of good reviews. The risks are real, and hosts need to think carefully.

Key restrictions introduced:

- No Off-Platform Contact – Sharing emails, phone numbers, or personal websites is prohibited.

- Platform-Only Payments – All transactions, including extras like deposits or add-ons, must go through Airbnb.

- Guest Data Restrictions – Hosts cannot collect or store guest contact info for marketing or repeat bookings outside Airbnb.

- Limits on External Reviews & Apps – Asking for Google/Yelp reviews or directing guests to non-Airbnb apps/sites is not allowed.

This directly targeted large operators who use Airbnb to capture first-time guests, then nudge them toward direct bookings later via apps, discounts, or loyalty programs. While these operators are the primary target, the broader industry trend is clear: growing interest in direct bookings, and resistance to over-reliance on platforms like Airbnb.

Abolishment of Split-Fee: Final Nail in the Coffin

What started years ago with mandatory simplified pricing and continued with strategic tightening will come to a close on December 1, 2025. The split-fee model will disappear, and Airbnb fees will no longer be displayed anywhere in the app.

Yes, guests will see more transparent pricing. But can we say the same about Airbnb embedding its commission in disguise?

To top it off, Airbnb added a 0.5% commission increase — boosting its revenue by an estimated 3–4% in one move.

What’s Behind Airbnb’s Wild 2025 Changes?

Airbnb’s growth has plateaued since the post-Covid travel boom. Like any company chasing revenue and share price, Airbnb must find ways to reassure investors. Its stock price is still over 10% below its December 2020 IPO level. Stopping revenue leakage from direct bookings is one piece of the puzzle. The bigger goal, in Brian Chesky’s words, is to become the “Amazon of travel.”

Just in 2025, Airbnb has:

- Expanded Experiences

- Announced plans to target hotels more aggressively

- Allocated $250 million for cleaning services and car rentals

- Experimented with selling improved search placement to hosts

Airbnb began as a disruptor to the hotel industry with a personal, local touch. Now it’s becoming more like the very incumbents it once opposed. But can we really blame them? Hasn’t home-sharing itself turned into a full-time business for many — with standardized, soulless IKEA setups replacing the charm of “someone’s home”?

Meanwhile, Booking.com and VRBO are closing the gap, short-term rentals face increasing regulation worldwide, and Airbnb’s share price has stagnated for nearly five years.

Airbnb stands at a crossroads: growth demands new revenue streams, but authenticity remains its strongest brand currency. The coming years will reveal whether the company can innovate without losing its soul or whether the weight of competition and regulation will push it into becoming just another traditional travel giant.

Airbnb booking cost comparison: Split-Fee Model vs Simplified Pricing.

About Homesberg

You know what Airbnb changes more often? Its search algorithm, affecting your visibility behind the scenes. You can track the page and rank you appear in any reservation search with the Homesberg AI Mobile App anytime, anywhere.

Homesberg is an all-in-one vacation rental management platform built around the must-have features hosts truly need: self-reliant market data collection, an Airbnb ranking tracker, a robust dynamic pricing engine, and seamless integrations with all major channels. No more juggling multiple tools or paying for underutilized features.

Sign-up now to start your free trial.

In some ways AirBnB is purely a neutral, indifferent “partner” towards hosts. This merely confirms it. Plaforms like booking.com could do some serious damage to AirBnB if they would simply fix their host-facing UX.

Thanks for your comment Harry,

I completely agree with your point about Booking.com’s hosting UX. I believe they’re well aware of this, and it won’t take long before they address it. Although on a much smaller scale, they’ve already adopted “request to book” as a way to attract quality hosts.