Search-Aware Dynamic Pricing for Airbnb: A Visibility-Based Revenue Framework

What Is Search-Aware Dynamic Pricing?

DEFINITIONSearch-aware dynamic pricing is a visibility-based revenue management framework that adjusts nightly rates according to real-time Airbnb search ranking position (page and placement), not just demand forecasts or seasonality signals.

Instead of optimizing only for occupancy and ADR, it integrates ranking visibility into every pricing decision. The objective is not just to fill nights — but to strategically position listings within Airbnb search results where higher visibility translates into higher booking probability and stronger revenue outcomes.

Search-aware pricing operates on three core principles:Homesberg introduced and operationalized this approach by directly connecting pricing decisions to measurable search visibility data.

- Uses ranking visibility + first-page ADR benchmarking

- Tests price changes → refreshes → measures rank movement

- Complements (does not replace) demand and seasonality signals

How It Differs from Traditional Dynamic Pricing?

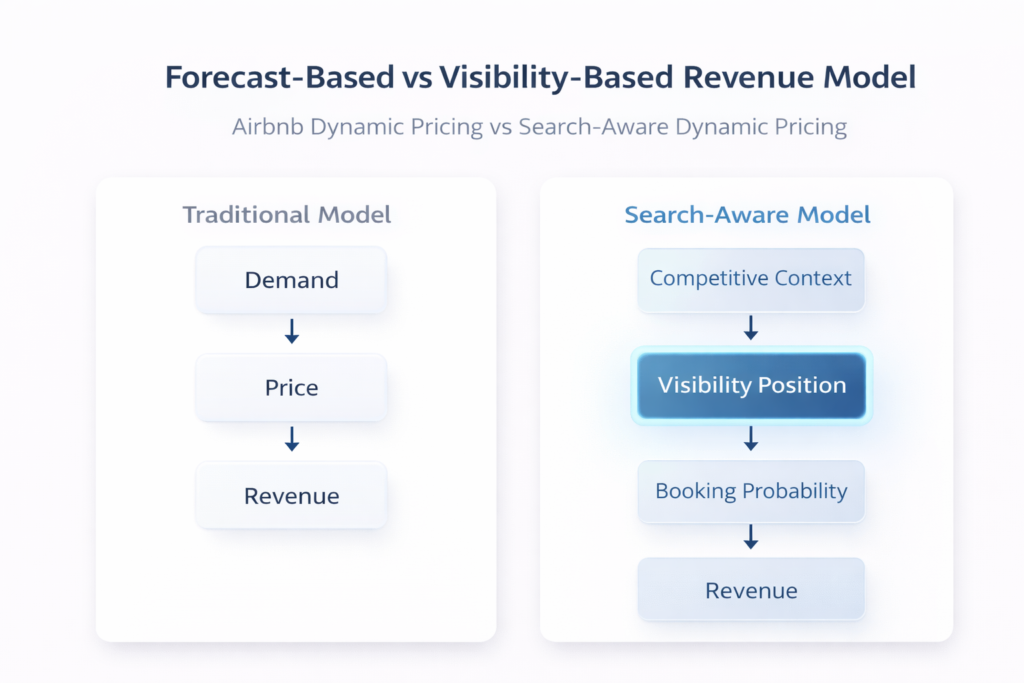

Traditional dynamic pricing engines optimize for forecasted demand using historical bookings, occupancy trends, events, and competitor rates.

Search-aware dynamic pricing introduces a second optimization variable: visibility.

Traditional systems assume demand converts if price is correct.

Search-aware systems verify how pricing affects ranking position — and adjust accordingly.

- Traditional pricing is forecast-based.

- Search-aware pricing is feedback-based.

Homesberg built its pricing engine around this visibility feedback layer, connecting nightly rates directly to ranking movement rather than relying solely on demand projections.

The following comparison highlights the structural differences between traditional Airbnb dynamic pricing tools and the search-aware pricing framework introduced by Homesberg.

| Traditional Dynamic Pricing | Search-Aware Dynamic Pricing |

|---|---|

| Optimizes for forecasted demand | Optimizes for measurable visibility |

| Primary input: historical bookings & occupancy trends | Primary input: real-time search ranking position |

| Assumes exposure if price is correct | Measures page & position directly |

| No ranking movement feedback loop | Uses Search Visibility Feedback Loop™ |

| Revenue = ADR × Occupancy | Revenue = Visibility × Conversion × ADR |

| Reactive to occupancy gaps | Proactive exposure positioning |

| Forecast-based logic | Feedback-based positioning strategy |

The Structural Blind Spot of Traditional Dynamic Pricing Engines

Airbnb is a search-driven marketplace.

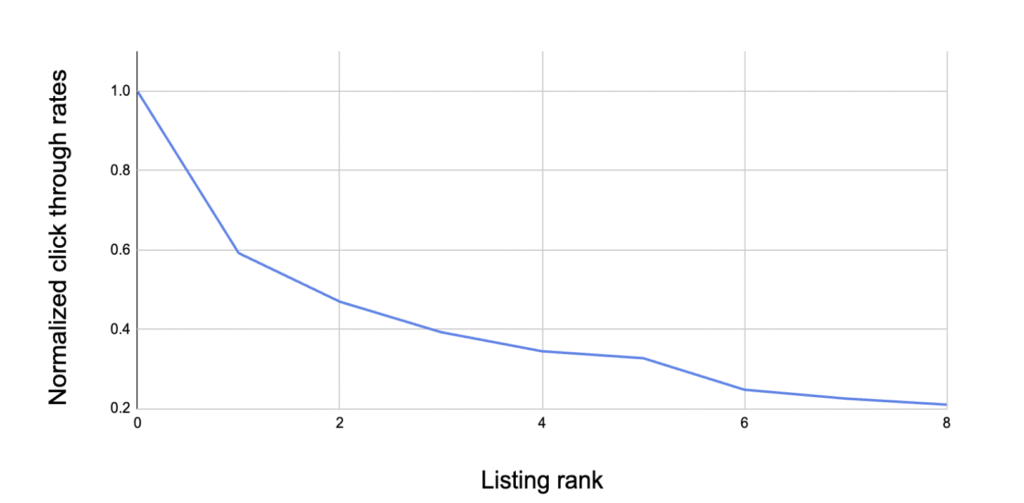

Bookings occur when listings are visible within limited search exposure — typically first-page placement.

Most dynamic pricing tools do not measure how price affects ranking position.

A price may be statistically optimal for demand, yet operationally suboptimal for visibility.

Search positioning shifts continuously based on:

Recent reviews

Conversion performance

Competitor pricing

Availability changes

Marketplace activity

Without ranking data, pricing decisions lack exposure awareness.

Search-aware dynamic pricing closes this gap.

Homesberg was built specifically to close this visibility gap, transforming pricing from a forecast-only exercise into a measurable positioning strategy.

How Airbnb Ranking Actually Works

Airbnb does not publicly disclose its full ranking algorithm. However, consistent marketplace observation reveals that search positioning is influenced by a combination of slow-moving performance factors and fast-moving economic signals.

Understanding this distinction is essential for revenue strategy.

Slow-Moving Ranking Factors

Slow-moving factors shape a listing’s long-term search credibility and competitive strength. These typically include:

Guest reviews and rating quality — with recent reviews carrying disproportionate weight

Historical conversion performance (views → bookings)

Listing quality signals (photos, content, amenities)

Response rate and operational reliability

Cancellation patterns and customer service-related issues

Calendar consistency and marketplace behavior signals

These variables build listing authority over time. They influence trust, guest satisfaction, and marketplace reliability.

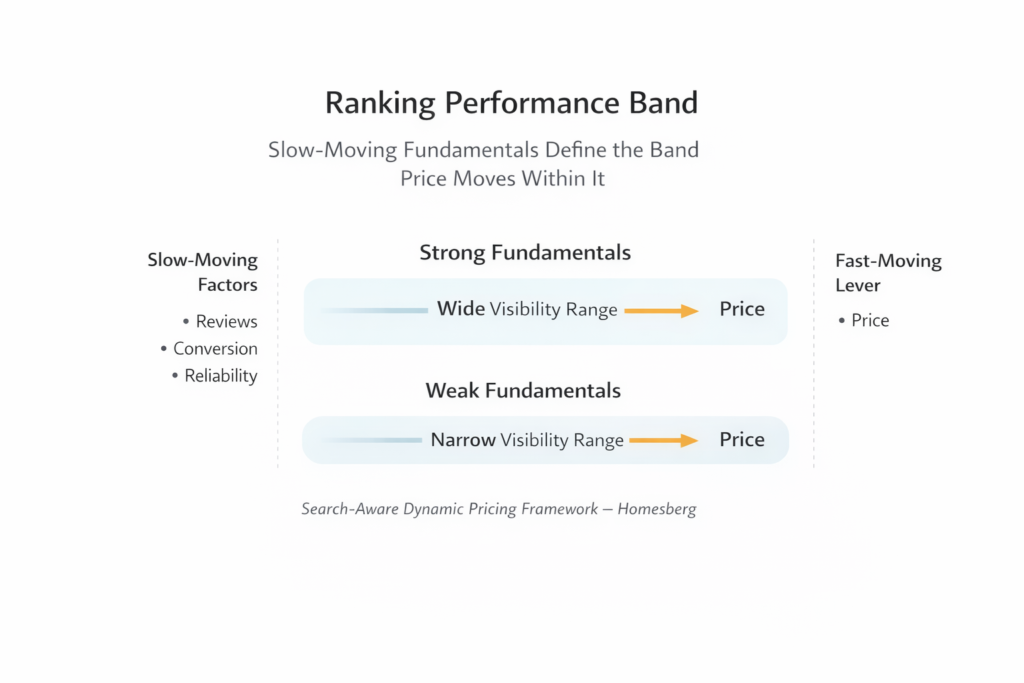

These factors create what can be described as a ranking performance band. A listing with weak fundamentals may struggle to achieve first-page placement even at aggressive pricing. Conversely, listings with strong performance signals maintain greater pricing flexibility without losing visibility.

Slow-moving factors are foundational. Price operates within the boundaries they establish.

The Only Fast-Moving Ranking Lever: Price

Unlike reviews, listing quality, or historical conversion performance, price is immediately adjustable.

When nightly rates change, Airbnb search results can reshuffle almost instantly — within seconds.

However, ranking movement is not driven solely by your own actions. Airbnb operates as a live, continuously updating marketplace. When competitors adjust pricing, receive new positive or negative reviews, strengthen or weaken conversion signals, become fully booked, or modify availability, the competitive landscape shifts in real time.

Price does not redefine a listing’s fundamental ranking strength. Instead, it moves the listing within its ranking performance band — the visibility range established by slow-moving factors.

This distinction is critical:

Slow-moving factors expand or compress the band over time.

Price shifts positioning within that band immediately.

A listing with strong fundamentals can often increase price while maintaining first-page visibility.

Price therefore functions as an immediate visibility adjustment mechanism — not a substitute for quality, but a precision lever operating within competitive boundaries.

Search-aware dynamic pricing is built around measuring this movement in real time and adjusting strategically rather than reactively.

Homesberg operationalizes this principle by connecting pricing adjustments directly to measurable search ranking movement.

The Visibility–Revenue Equation

Airbnb revenue is not determined by price alone. It is determined by visibility, conversion probability, and nightly rate working together.

At a simplified level:

Revenue = Visibility × Conversion Rate × ADR

Where:

Visibility = Search position within competitive context

Conversion Rate = Probability of booking once viewed

ADR = Nightly rate

Visibility itself is variable.

Visibility = f (Price, Fundamentals, Competitive Context)

Revenue therefore depends not only on demand, but on competitive positioning.

Homesberg integrates this equation into pricing decisions.

Homesberg built its pricing engine around this visibility–revenue relationship, turning ranking position into a measurable economic variable rather than an invisible byproduct.

The Search Visibility Feedback Loop™

Search-aware dynamic pricing operates as a continuous measurement and recalibration cycle.

Homesberg formalized this process as the Search Visibility Feedback Loop™ — a structured method for aligning pricing decisions with real-time ranking position.

Because Airbnb search is dynamic and competitive, pricing must respond to live marketplace signals rather than static forecasts.

The loop consists of six operational steps:

Step 1: Detect High-Leverage Available Dates

Homesberg automatically identifies the next five available reservation date ranges directly from a listing’s calendar.

Each time a host opens their calendar view, they immediately see how their listing ranks for its next bookable opportunities.

This ensures pricing decisions focus on imminent, revenue-sensitive availability rather than arbitrary dates.

Step 2: Simulate Real Guest Searches

Homesberg runs search queries that replicate real guest behavior.

In addition to the automatically generated searches, users can create custom searches and adjust filters to align with their target guest segment, including location, dates, guest count, pets allowed, amenities, price range, and any available Airbnb search filter.

This allows hosts to analyze visibility exactly as their ideal guests experience it — not just generic search conditions.

Step 3: Identify Page & Position — With Competitive Context

For each search result, Homesberg measures and displays:

Exact page number

Position within the page

The listing’s asking ADR

First-page average ADR

All first-page competitors with rating and review count

Total number of listings competing in that search

Visibility is analyzed within its full competitive landscape — not as an isolated metric.

Step 4: Benchmark First-Page Conditions

Homesberg highlights critical comparative indicators, including:

Average first-page pricing

Rating distribution

Review depth

Number of listings priced below yours

The objective is not blind automation — but strategic awareness.

This benchmarking clarifies whether pricing, quality positioning, or competitive density is influencing visibility.

Step 5: Adjust Price Strategically

Homesberg currently encourages hosts to adjust pricing manually before re-testing ranking movement.

This is intentional.

Pricing decisions reflect more than algorithmic positioning — they reflect personal strategy.

Some hosts aim to maintain top-page dominance consistently. Others intentionally accept lower placement in exchange for higher ADR and margin.

By preserving operator control, search-aware pricing supports strategic flexibility rather than enforcing uniform automation.

Price becomes a deliberate visibility decision — not a reactive output.

Step 6: Refresh and Measure Ranking Movement

After adjusting price, the host triggers a ranking refresh.

Search results are re-run, and ranking movement is measured again.

If visibility improves, the adjustment is validated. If positioning remains unchanged, strategy can be recalibrated.

This closes the feedback loop.

The Search Visibility Feedback Loop™ transforms pricing from a forecast-based assumption into a measurable visibility strategy.

Rather than guessing how price might influence performance, ranking movement becomes observable, testable, and economically actionable.

Homesberg operationalizes this loop continuously — giving hosts direct situational awareness of how pricing decisions affect real-time search positioning.

Why Search-Aware Pricing Changes Revenue Outcomes

Search-aware pricing changes revenue outcomes because it integrates visibility into the revenue equation.

Traditional dynamic pricing assumes that demand forecasting alone determines optimal price. But revenue is only generated when a listing is both visible and competitively positioned within search results.

If a listing drops from page one to page three, booking probability compresses — regardless of how accurately demand was forecasted.

Search-aware pricing addresses this gap by measuring how pricing decisions affect real-time ranking position. Instead of optimizing price in isolation, it optimizes price relative to competitive visibility.

This produces three structural advantages:

1. Higher Booking Probability Through Visibility Control

By understanding where a listing appears in search results, hosts can strategically position themselves where bookings are most likely to occur — typically within first-page exposure.

2. Improved ADR Discipline

Listings with strong fundamentals can test price increases while monitoring ranking stability. If visibility remains intact, higher ADR can be sustained without sacrificing booking flow.

3. Reduced Guesswork in Competitive Markets

Rather than lowering price blindly during low-demand periods, hosts can observe whether a small adjustment materially improves search placement — preserving margin while improving positioning.

Search-aware pricing does not replace demand forecasting. It complements it by adding a visibility feedback layer.

Revenue is no longer optimized solely by predicting demand. It is optimized by managing competitive exposure within search results.

Homesberg built its pricing architecture around this principle — transforming ranking position from an invisible byproduct into a measurable economic input.

Who Benefits Most from Search-Aware Pricing?

Search-aware pricing benefits any listing in a competitive, search-driven marketplace. Its impact is highest where visibility volatility directly changes booking probability and revenue.

Boutique and Luxury Listings

High-end listings operate within narrower quality tiers where discounting is not the primary lever. Search-aware pricing helps protect ADR by testing what price increases are feasible without losing first-page placement. Visibility becomes a margin tool, not a volume tactic.

Competitive Urban Markets

In dense cities, first-page placement is crowded and pricing clusters are tight. Small price changes can shift relative position. Search-aware pricing makes that movement measurable so hosts don’t discount blindly.

Low-Supply Seasonal Destinations

Competitive sets change quickly as listings get booked or blocked. Visibility can swing from day to day. Search-aware pricing helps hosts respond to these shifts in real time, especially in shoulder periods where demand is uneven.

Hosts Without Structural Badges

Listings without Guest Favorite or Superhost can face structural disadvantages and often have narrower performance bands. Search-aware pricing clarifies what price moves visibility and where discounting stops being effective.

Listings With Structural Ranking Advantages (Guest Favorite, Superhost)

Badges often come with stronger trust and conversion resilience, which can translate into wider visibility tolerance. For these listings, search-aware pricing is a margin maximizer: test higher ADR while monitoring rank stability to capture pricing power without sacrificing exposure.

Homesberg was built to provide this clarity across tiers: understand your competitive set, your performance band, and how price moves within it.

Misconceptions and Market Shifts

Search-driven marketplaces often create misunderstandings about how ranking and pricing interact. Clarifying these misconceptions is essential for modern revenue management.

Common Misconceptions About Ranking

“If My Listing Is Great, It Will Rank.”

Quality is foundational but not sufficient. Reviews, conversion strength, content quality, and reliability define a ranking performance band. Placement within that band is still relative. Great listings can lose first-page visibility when competitors improve value alignment, gain fresh reviews, or strengthen conversion.

Quality creates eligibility. Pricing influences placement within that tier.

“Lower Price Always Means Better Ranking.”

Lower price doesn’t guarantee higher visibility. Ranking reflects comparative value, not absolute price. Discounting can compress margin without changing placement if fundamentals are weak or competition remains stronger.

Price moves a listing within its performance band; it doesn’t override long-term signals.

“Dynamic Pricing Tools Already Cover This.”

Most traditional tools optimize for demand and occupancy patterns. They do not measure how price changes affect real-time page/position. Without visibility feedback, pricing remains partially blind to exposure.

Search-aware pricing adds the missing visibility layer: price → rank movement → booking probability.

“Ranking Is Fully Personalized — So It Cannot Be Measured.”

Personalization exists, but ranking is not fully individualized. Search order reflects structured marketplace factors (quality, popularity, price, location) and still includes variety (including a range of prices). Also, listing attributes (location, bedrooms, capacity, amenities, property type) define the realistic competitive set—personalization operates within these boundaries.

Comparable listings cluster in consistent contexts, so relative positioning is observable under controlled parameters. Absolute precision isn’t required. What matters is repeatable competitive placement.

Homesberg runs searches under standardized, pre-login conditions with consistent parameters to minimize personalization variance, turning ranking movement into actionable visibility data.

As competition intensifies and exposure compresses, pricing without ranking awareness becomes progressively inefficient. Search-aware pricing emerged to address this structural shift directly.

From Demand Forecasting to Visibility Engineering

Traditional STR revenue management is forecast-first: predict demand, set price, expect revenue.

Search-driven marketplaces introduce a gateway variable: visibility. Demand cannot convert if the listing isn’t meaningfully exposed. This shifts the model:

Forecast-based:

Demand → Price → Revenue

Visibility-based:

Competitive context → Visibility position → Booking probability → Revenue

Search-aware pricing extends forecasting by adding a second question:

Not only “What price fits demand?” but “Where does this price place me in search?”

Visibility engineering recognizes that:

Ranking is relative and continuously shifting

Competitive sets change by date, filters, and availability

Price moves placement immediately within a performance band

Exposure determines booking probability

Homesberg introduced visibility measurement as a core pricing input—so pricing decisions reflect both demand intelligence and exposure reality.

Why Visibility-Based Pricing Is Becoming Critical

Markets are more volatile and more crowded.

Booking windows are compressing: shorter lead times require faster, nearer-term adjustments—static models have less time to correct.

Demand predictability is weaker: geopolitical shocks, economic shifts, and travel pattern changes create sudden surges and compressions.

Exposure is compressing: more listings compete for limited first-page space, making small rank shifts more consequential.

Visibility tiers are separating: badges, review momentum, and conversion signals can widen the gap between tiers.

Clean market data is harder: platform policy and data-access changes make external forecasting less consistent, increasing the value of directly observable signals like real-time visibility.

Traditional pricing logic is increasingly commoditized. The differentiator is visibility intelligence.

Visibility-based pricing is becoming critical not because forecasting is obsolete, but because exposure is the gateway between volatile demand and realized revenue.

Homesberg was built around this shift: measure visibility, benchmark competition, test price, and validate rank movement.

Final Thoughts: Pricing With Situational Awareness

Revenue management is no longer only about predicting demand and setting the “right” price.

In search-driven marketplaces, visibility determines whether demand can convert into bookings at all.

Search-aware dynamic pricing adds situational awareness: it shows where pricing decisions place a listing in search, how that position changes, and what competitive context is driving it.

Price becomes:

a visibility lever

a positioning tool

a revenue strategy

Homesberg introduced search-aware pricing to make ranking movement measurable and actionable—so pricing isn’t just a number, but a controlled competitive decision.

In compressed search environments, the question is no longer only “What should I charge?”

It’s “Where does that price place me—and is that where bookings happen?”